What would happen if prices keep increasing forever at a rapid rate?

Explaining Hyperinflation

The scenario where the prices of goods increase rapidly and things go beyond the control of the government is called hyperinflation.

In a hyperinflation scenario, the following things happen:-

The prices of goods shoot up at a great pace. for eg. prices of some goods may double within a few days

Shopkeepers would not like to sell their inventory because they will be getting higher prices in the future.

Buyers would buy in large quantities because the prices are going to increase in the future.

People lose trust in their currency and may use a barter or foreign currency.

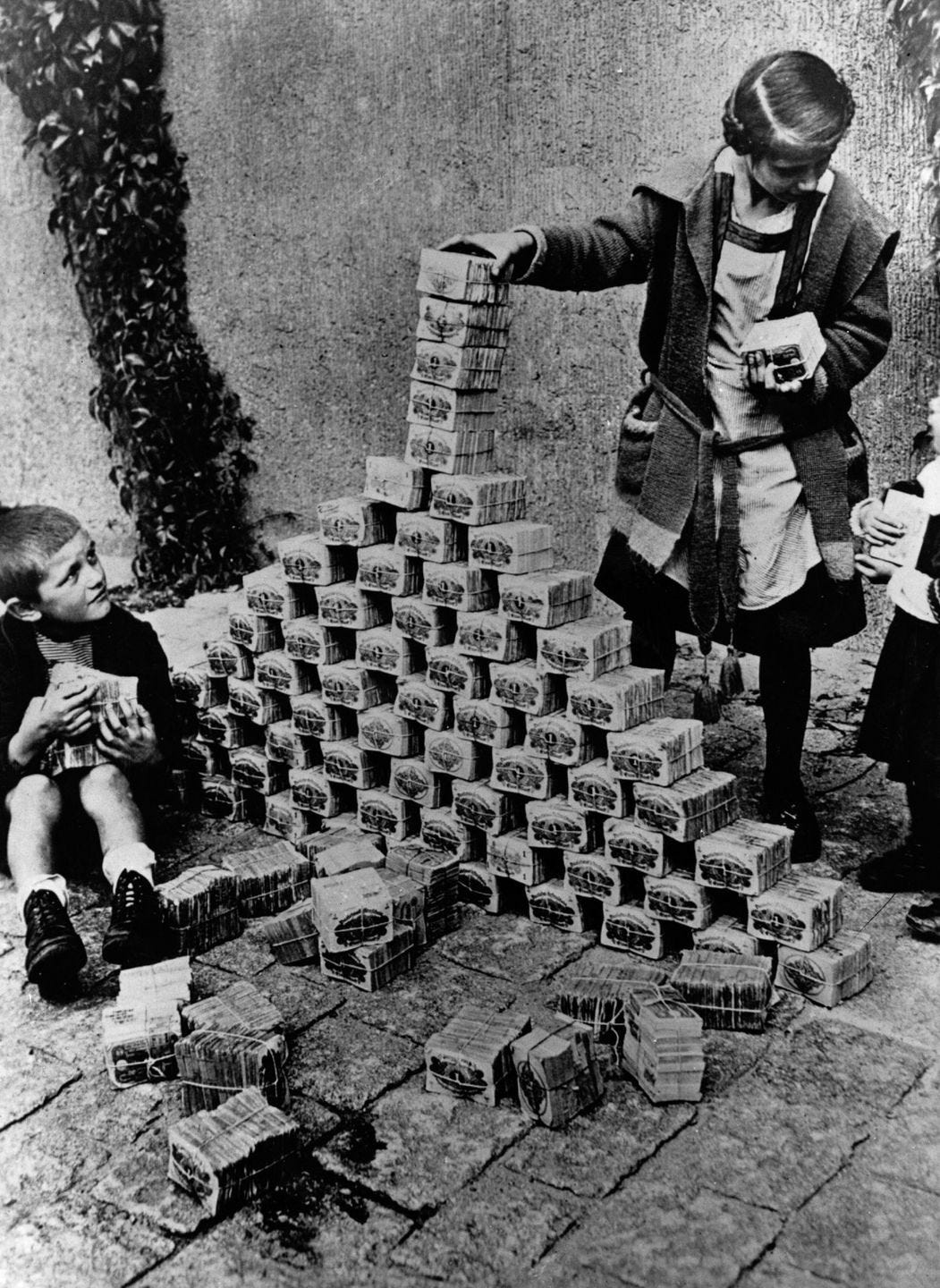

The loss of trust in their currency can be seen in the images below

Above is the image of children playing with German currency notes.

Venezuela’s currency has lost its value so much that people were doing crafts with their currency.

There are many instances where hyperinflation has caused havoc in various economies, such as:-

Weimar Republic {Germany} (1920s)

Hungary(1945) [The worst in history with prices of goods doubling every 15 hours]

zimbabwe( 2007)

etc.

SO HOW DOES HYPERINFLATION HAPPEN?

The most common factor contributing to hyperinflation is excessive money printing done by the government to stimulate or boost the economy, but things go wild and get out of control.

let us understand this with the example of the Weimar Republic ( present-day Germany)

As we know the world war broke out in the year in the year 1914. The German government decided to fund the entire war by borrowing from its public by issuing war bonds. They intended to repay the debt to the public by winning the war and imposing war reparations or war payments to the Allies. however, the opposite happened.

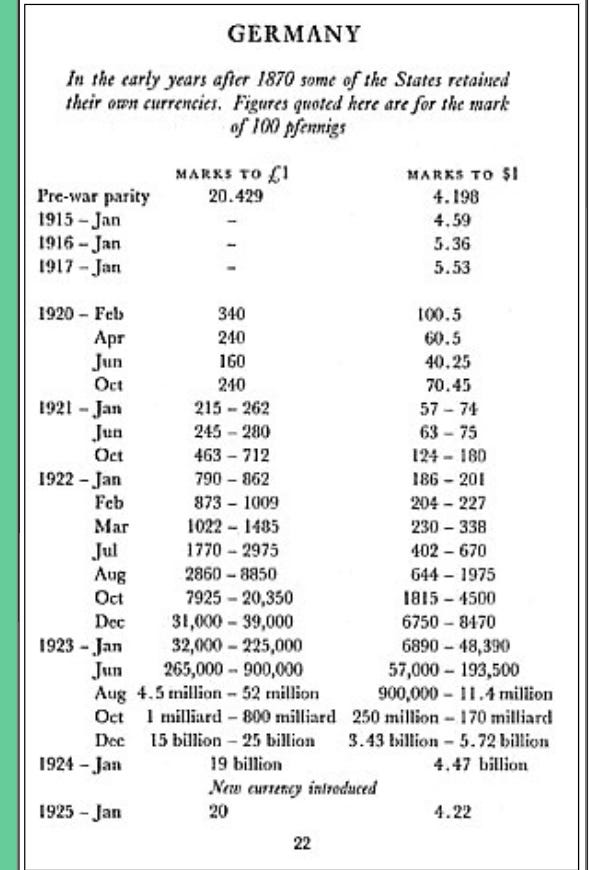

Germany lost the war and the Enemies imposed war payments on Germany by making them sign the Treaty of Versailles. the treaty demanded 132 billion gold marks to be paid in gold or foreign currency. Germany defaulted on its payments and also the value of the pound to mark fell drastically. now they had to pay to extra amount of German currency to pay the same payments.

the following table shows how fast the German mark has devalued over the years and eventually scrapped.

since Germany was unable to make payments, France and Belgium proceeded to take over the Ruhr region which was the industrial heart of Germany. this led to conflicts and protests in the region productivity fell which meant less tax collections, and the prices of goods skyrocketed. this left the government with no option but to print money. the circulation of currency increased by 5 times in 5 years. people had to carry carts just to buy bread, some started burning notes for warmth and some started using the barter system the political instability also didn’t help either, people’s savings were blown away in a few months.

fast forward 100 years from now the USA has done the same thing of money printing but the USA currency has reserve currency status meaning the USD has the backing of global productivity. will the same thing happen in USA as well? only time will tell. that’s a wrap on this article.

If you like my articles please subscribe to my newsletter

Thank you for reading :)

Please ignore three subscribe buttons 😬